Casino Queen Win Loss Statement

To request gaming history statements, please print and complete the win/loss request form. To request gaming history statements, please print and complete the win/loss request form. Rivers Casino c/o Win/Loss Request 3000 S. Des Plaines, IL 60018. Or scan and email completed requests to: email protected Address. If you have questions regarding the Request Form or your Win/Loss statement, please contact us at 618-261-8995 or email winloss@casinoqueen.com. 5700 Pacific Highway East, Fife, WA 98424. EMERALD QUEEN CASINO & HOTEL IN TACOMA. 2920 East R Street, Tacoma, WA 98404.

Win/Loss Statement. Receive a Win/Loss statement from Grand Victoria Casino. TEMPORARILY CLOSED. Club GVC Power Points & Rules. Join Club GVC and start experiencing the thrill of exciting membership rewards!

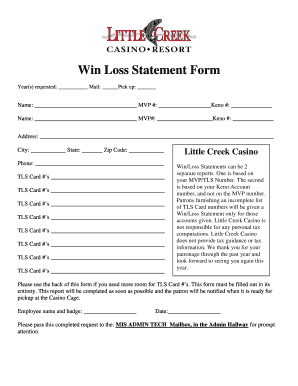

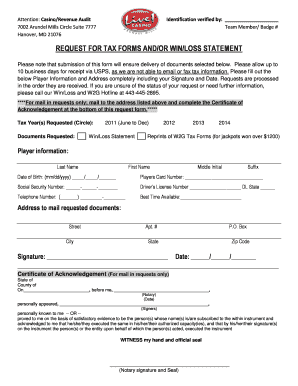

A casino win/loss statement is a report or letter from a casino that summarizes a person’s gambling activity. Typically, such reports total the gambler’s activity by year, activity, and location.

Frequently, the IRS refuses to accept a casino’s win/loss statement as evidence of a gambler’s losses. As an alternative, the IRS recommends that a gambler use a gambling diary or log to record their transactions by gambling session.

Caesars Casino Win Loss Statement

In general, many gamblers prefer to use casino win/loss statements because they are easily obtained from the casino. However, what many gamblers don’t realize is that casino win/loss statement can actually cause a gambler to pay more income tax.

Hollywood Casino Win Loss Statements

Riverwind Casino Win Loss Statement

Furthermore, the “disclaimer” language which states that that information contained in the casino win/loss statement is not reliable or accurate causes both the IRS and gamblers much consternation, confusion and aggravation.

It is important to remember that casino win/loss statements are not “official” IRS forms like Form W-2G Certain Gambling Winnings or Form 5754 Statement by Person(s) Receiving Gambling Winnings. As a result, the IRS does not regulate the format or time of delivery of casino win/loss statements.

Casino Queen Win Loss Statement

For more specific information regarding a particular casino win/loss statement, please contact the casino or a qualified tax professional.